“Urgent Need” For Central Banks to Adapt to AI: BIS

Hi! You’re reading AI Street, a weekly newsletter about how AI is reshaping Wall Street. I’m Matt Robinson and every Thursday I share the latest news, analysis and AI tools for investors.

REGULATION “Urgent Need” For Central Banks to Adapt to AI: BIS

The Bank of International Settlements, known as the central bank for central banks, said there’s an “urgent need” by policymakers to better understand how AI is impacting the economy.

Central bankers also need to leverage the technology to help monitor data in real time to better track inflation, according to a Tuesday report.

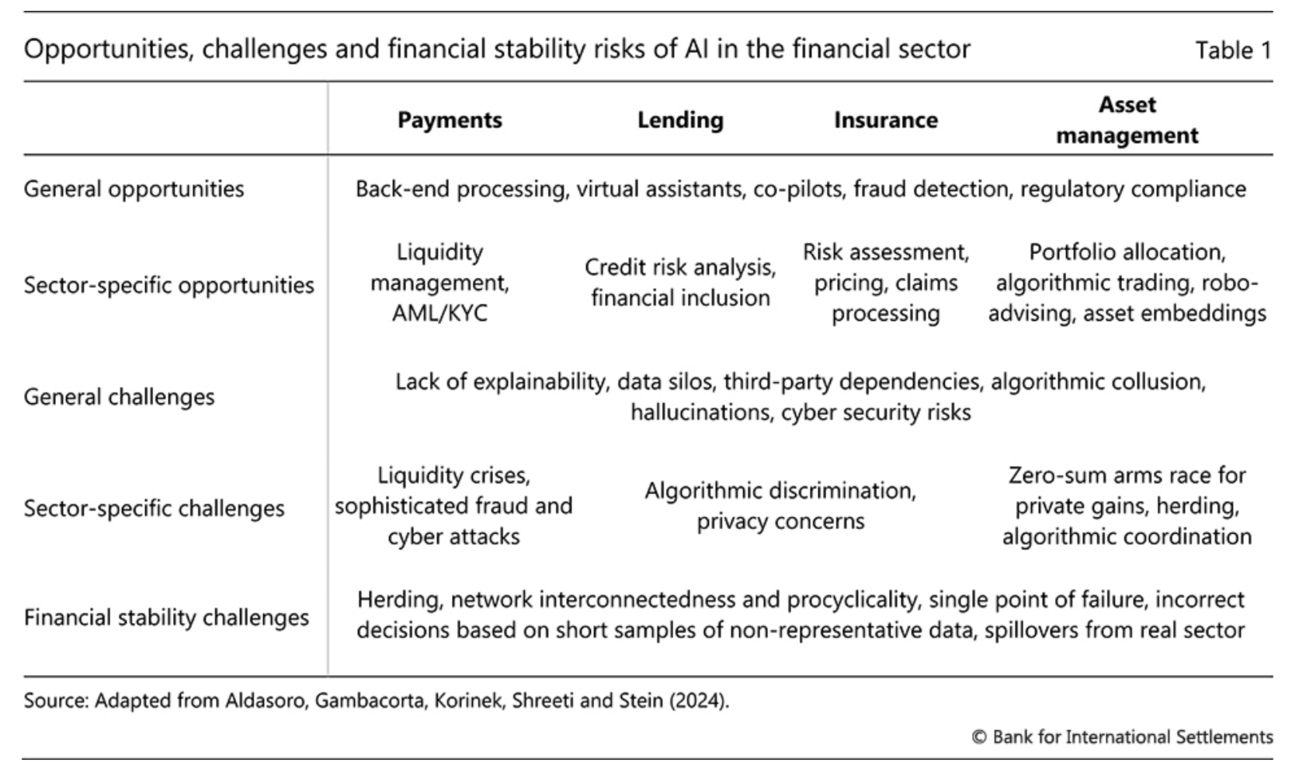

AI has the potential to significantly enhance efficiency and lower costs in the financial sector, particularly in back-end processing, regulatory compliance and customer service, according to the BIS. For example, software developers can code more than twice as many projects per week when using LLMs through the GitHub Copilot AI.

The technology can also create sentiment indexes and detect money laundering. An LLM fine-tuned with financial news can create a sentiment index by extracting from social media posts, financial statements, and earnings transcripts. AI can also outperform traditional methods in tracking money laundering, potentially boosting correspondent banking, which has been in decline, according the BIS.

The tech also introduces risks, including potential bias and discrimination in credit decisions, data privacy issues and the lack of explainability in AI outputs.

Other use cases highlighted in the report:

Improved credit scoring by leveraging unstructured data.

Assessing property damage by analyzing images and videos for insurance claims.

Predicting returns and optimizing portfolio allocation.

BIG PICTURE:

The BIS warning follows a U.S. Senate report last week that found regulators are behind in policing AI risks, which have been amplified by the tech’s rapid growth. ChatGPT has the fastest adoption rate of any technological breakthrough ever, easily outpacing the internet, smartphones and electricity. More than half of U.S. households have used a Gen AI tool in the last year, per the report.

Further Reading:

Citigroup published a 124-page report last week on how AI will impact financial services.

FUNDRAISING Norm Ai Raises $27 Million for AI-Driven Regulatory Tech Platform

Norm Ai raised $27 million in Series A funding Tuesday to expand its regulatory technology platform, which uses a proprietary language that converts regulations into computer code that can be read by large language models.

The New York-based company says Fortune 100 firms are using the technology currently for regulatory assessments. Insurance companies and asset managers are boosting efficiency by speeding up the publication of highly regulated content, according to a June 25 press release.

Norm Ai is designed to provide clear, actionable explanations of compliance findings, letting users self-serve initial rounds of regulatory compliance reviews.

Coatue Management led the round. Other investors that participated include: Bain Capital Ventures, Blackstone Innovations Investments, New York Life Ventures, Citi Ventures, TIAA Ventures, and Jefferson River Capital, the family office of Tony James, the former President and COO of Blackstone.

In under a year, the company has raised more than $38 million from leading firms.

BIG PICTURE:

“Going through compliance” at many companies is often a slow and tedious process. Given that regulations have grown in size and complexity, an AI agent used by a non-regulatory employee would reap significant gains across multiple industries.

BlueFlame Raises $5 Million for AI for Alternative Investment Managers

BlueFlame AI, a generative AI platform made for alternative investment managers, raised $5 million in Series A funding after launching in October, according to a June 25 press release.

The platform helps manage unstructured data, speeding up the review of earnings transcripts, sell-side research and regulatory filings. Clients include private equity managers, hedge funds, and private credit firms that manage hundreds of billions in assets.

BlueFlame is seeing interest from small and larger money managers after planning to focus on the boutique space, according to James Tedman, head of Europe at BlueFlame AI, in an interview with LSEG.

“It’s very hard to hire people to build tools like this, and it’s even harder to keep them because the industry is so hot right now. A lot of firms, both small and large, have recognized it’s easier to work with a partner," he said.

BIG PICTURE:

AI’s ability to make sense of unstructured data has huge potential for private investments, which are generally harder to track than public markets.

Have an innovative or underreported AI use case for finance? Reach out: matt@ai-street.co

AI ADOPTION Biggest Companies Leading AI Adoption: Fed CFO Survey

Almost two-thirds of CFOs expect their companies to automate tasks typically done by humans, with a majority of those firms planning to implement AI for a wide range of tasks, according to a Fed survey of 450 finance executives.

About 54% of companies implementing automation strategies plan to use AI, according to the survey, which was conducted by Duke University and the Federal Reserve.

The biggest firms are leading AI adoption with 76% planning to leverage the technology.

“CFOs say their firms are tapping AI to automate a host of tasks, from paying suppliers, invoicing, procurement, financial reporting, and optimizing facilities utilization,” said Duke finance professor John Graham, academic director of the survey. (Fortune)

BIG PICTURE:

The survey is the latest to show increased corporate interest in AI. Last month, McKinsey published a report that showed that AI adoption has increased dramatically after years of little meaningful change.

ALSO IN THE NEWS Anthropic’s Artifacts Looks to Boost Human-AI Collaboration in Business

Anthropic’s Artifacts helps create a workspace where users and AI collaborate in real time. (PYMNTS)

Cliff Asness Says the Machines Are Making More Decisions at AQR

AQR Co-founder Cliff Asness said machines are making more of an impact at the $109 billion hedge fund. “We let the machine decide more.” (Bloomberg)

Morgan Stanley Advisors to get an AI Assistant for Grunt Work

The bank is pushing further into its adoption of AI with a new assistant, Debrief, that is expected to save thousands of hours of labor. (CNBC)

Toys"R"Us Creates Commercial Using Text-to-Video AI Tool

The toy retailer used OpenAI's Sora to create an entire commercial. (NBC)

Thanks for reading! Feedback? Reach out at matt@ai-street.co.