Bridgewater Launches AI-Driven $2 Billion Fund

Happy 4th of July! 🇺🇸 🎆 You’re reading AI Street, a weekly newsletter about how AI is reshaping Wall Street. I’m Matt Robinson and every Thursday I share the latest news, analysis and AI tools for investors.

In This Week’s AI Street:

Bridgewater Launches $2 Billion Fund Run by Machine Learning

80% of Credit Risk Execs Plan to Use Gen AI Within a Year: McKinsey Survey

HEDGE FUNDS Bridgewater Launches $2 Billion Fund Run by Machine Learning

Bridgewater, one of the world’s largest hedge funds, launched a $2 billion fund Monday that uses in-house machine learning to help make investment decisions with plans to include models developed by OpenAI, Anthropic and Perplexity, according to Bloomberg.

The new fund is run by co-chief investment officer Greg Jensen. Bridgewater has been testing the strategy since late last year with about $100 million from its Pure Alpha fund.

The hedge fund formed a division called Artificial Investment Associate (AIA) Labs last year that combines the latest technologies, including large language models, machine learning and reasoning tools. AIA’s technology, which uses AI to understand causal relationships in markets, is the primary decision-maker in the new fund while professionals will oversee risk management, data acquisition and trade execution.

In November, Jensen said its so-called "artificial investor" is exceeding expectations by making solid predictions on the euro and inflation, according to Business Insider.

BIG PICTURE

The hedge fund continues its push into AI. The Westport, Connecticut-based money manager has been exploring machine learning techniques for more than five years, according to a Senate report last month. The hedge fund is also experimenting with generative AI, which creates new content based on training data, but “only in approved and closely monitored circumstances,” per the report.

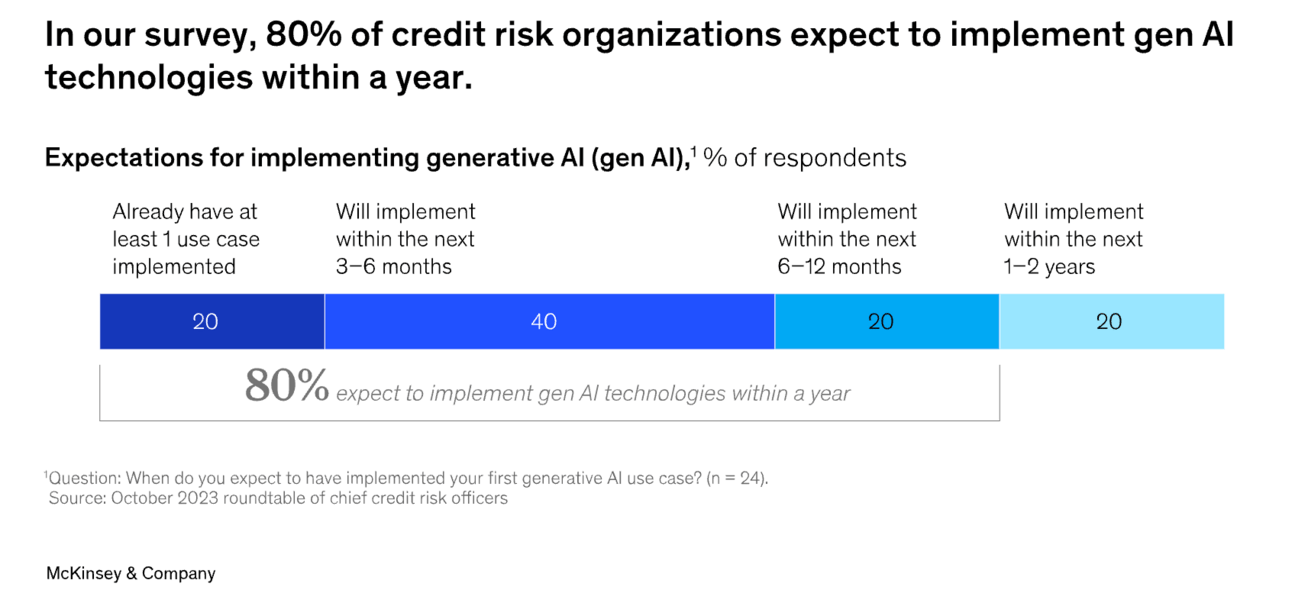

CREDIT RISK 80% of Credit Risk Execs Plan to use Gen AI Within a Year: McKinsey Survey

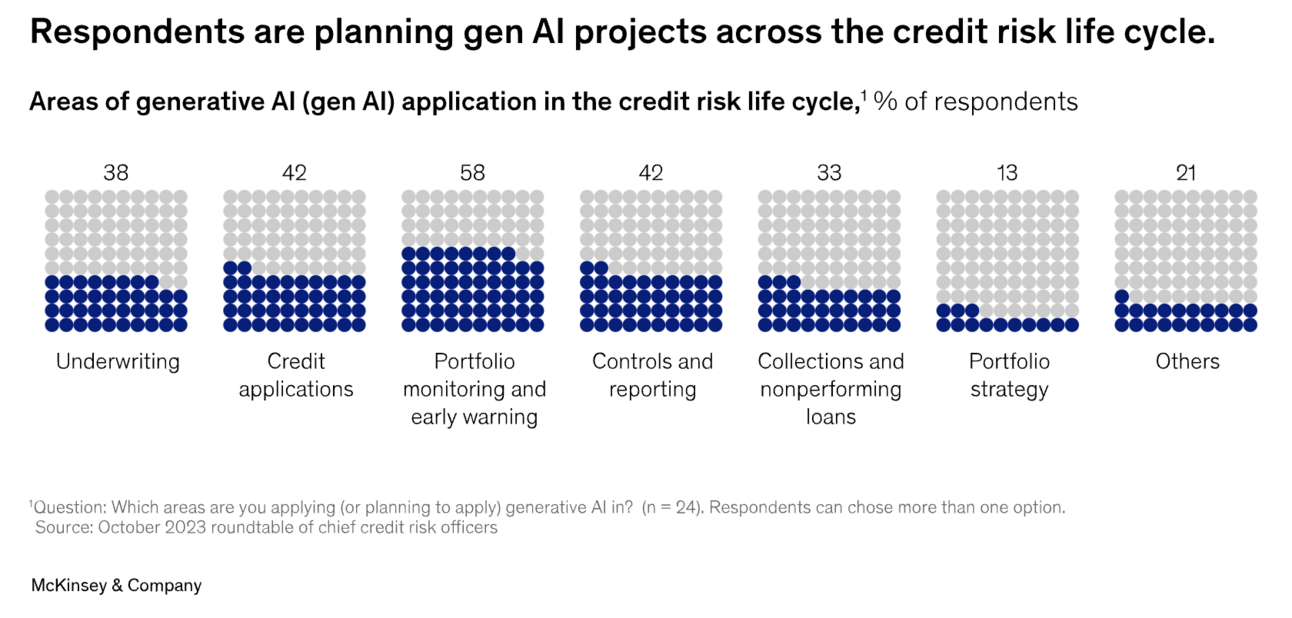

A majority of credit risk executives plan to implement Gen AI within a year to help with portfolio monitoring, reporting requirements, and underwriting, according to a McKinsey survey of 24 financial executives including nine of the top 10 banks.

Portfolio Monitoring

Gen AI tools can help create routine performance and risk reports, produce strategies in line with an organization’s risk appetite and optimize an existing early-warning system by consuming real-time unstructured information, such as news or market reports.

Reporting Requirements

Gen AI can speed up mundane tasks. For example, banks using the tech cut reporting time for climate risk disclosures from two hours to 15 minutes by pre-populating questionnaires with relevant information from annual reports.

Underwriting

AI can help compile information about customers, conduct credit analyses, and draft several sections of credit memos before credit officers review them.

BIG PICTURE

Gen AI is just getting started at financial institutions, which are currently launching the tools to boost efficiency. There’s more to come, according to McKinsey: even the most cautious of these executives believe that gen AI will be part of their companies’ credit risk processes within two years.

FUNDRAISING Hebbia Raises Almost $100 for AI-Driven Document Search

Hebbia, a startup using generative AI to search documents at scale, has raised almost $100 million in Series B funding led by Andreessen Horowitz, according to TechCrunch.

The company was launched in 2020 by George Sivulka, who was working on his PhD in electrical engineering at Stanford, after hearing how his friends working in the financial industry spent countless hours searching for information in SEC filings.

Current Hebbia clients manage more than $14 trillion in assets and include Centerview Partners, Oak Hill Advisors and Charlesbank Capital Partners, according to its website.

BIG PICTURE

Helping money managers cut down on manual document search is a huge opportunity. Hebbia was able to help clients quickly determine their exposure to regional banks amid the collapse of Silicon Valley Bank last year — a task that previously wasn’t feasible even with an army of lawyers, Sivulka told NBC in November.

BANKING Goldman Sachs Launches Its First Gen AI Tool

Goldman Sachs is rolling out a gen AI tool for code generation to thousands of developers this month, joining other Wall Street banks announcing plans for the new tech.

Developers are using the technology, known as the GS AI Platform, to build custom applications on top of certain models, such as a copilot tool for investment bankers to search public and proprietary documents to answer questions and extract analysis.

Goldman has tapped partnerships with OpenAI-backer Microsoft to use GPT-3.5 and GPT-4 models and Google for its Gemini model. The bank is also using open source models including Meta Platforms’ Llama.

The ability to switch between models for different use cases is a key benefit of the approach, Chief Information Officer Marco Argenti told the Wall Street Journal June 27.

BIG PICTURE

Goldman Sachs joins Morgan Stanley which recently made its gen AI tool available to its financial advisors. Banks are taking a cautious approach by deploying AI tools generally with internal use cases and lots of human oversight.

TRADING Robinhood Buys AI Platform For Investment Advice

Robinhood Markets Inc. acquired AI research platform Pluto Capital for tailored investment strategies and analysis to individual investors. Terms of the deal announced Monday weren’t made public.

Pluto’s AI-powered investing copilot integrates real-time market data, sentiment analysis, and analyst predictions for actionable insights, according to Pluto’s founder Jacob Sansbury, who’s joining Robinhood as part of the transaction.

BIG PICTURE

With AI, Robinhood may not need to hire an army of financial advisors to service its millions of customers. The acquisition helps the company speed up AI implementation.

AI + FIN LINKS Revolut CEO plans to disrupt venture capital with AI

Revolut founder Nik Storonsky has built a quantitative investment firm for early-stage companies that relies on algorithms and artificial intelligence over human input to source deals. (Bloomberg)

AI is changing banking, UBS executive says

The Swiss bank has been weaving artificial intelligence into its services and products for clients, going live last year with a pilot for instant credit geared towards small and mid-size companies which often have an urgent need for liquidity. (Reuters)

China leading generative AI patents race, UN report says

China is far ahead of other countries in generative AI inventions like chatbots, filing six times more patents than the United States, U.N. data show. (Reuters)

California advances AI safety bill despite tech firm opposition

California lawmakers voted to advance legislation Tuesday that would require AI companies to test their systems and add safety measures to prevent them from being potentially manipulated to wipe out the state’s electric grid or help build chemical weapons. (Associated Press)

Thanks for reading! Feedback? Reach out at matt@ai-street.co.